Table of Contents

1031 Exchange Depreciation Rules – 1031 Exchange Rules 2021 is a real estate term that refers to the swap in financial investment residential or commercial property in order to postpone tax obligations of capital gains. The name is gotten from Section 1031 of the IRS code, which defines capitalists, real estate professionals, as well as title firms.

There are lots of vibrant parts within Section 1031 that important to be recognized before you try to use them. Exchange can be done only for “like-kind” residential or commercial properties as well as the usages are limited for vacation residential properties by IRS.

What Are 1031 Exchange Rules?

As mentioned in prior, 1031 exchange is an act of swapping investment properties. It is also generally described as Starker or like-kind exchange. The majority of swaps apply for taxes as sales, but you might defer tax obligation or approved with restricted tax if you can satisfy the 1031 exchange’s needs.

As the outcome, according to Internal Revenue Service, you will be able to modify the investment kinds without the financial investment being acknowledged as capital gain or being squandered. This lets the investment keep on being postponed from tax obligation. 1031 is primarily can be done for unlimited quantities of times. You ‘d be capable to overthrow your property investment’s gain from one to another, and then to one more, and afterwards to another. You may not gain profit from every swap, however you will avoid tax up until the financial investment is sold, even if it takes years later on. If every little thing works out as the system is planned to be, after that you only require to pay a solitary tax at a 15% or 20% rate of capital gains in long-term, depends on your earnings. It can also be 0% if you’re classified as taxpayers with a lower revenue class.

The 1031 Exchange Rules 2021 is used for the residential property of business and financial investment just. Nevertheless, it might be able to apply to the major home residential or commercial property under some conditions. It is also really feasible to use 1031 for vacation properties, but the possibility is so low currently compared to times back.

What Are Types of 1031 Exchange Rules?

Simultaneous

Simultaneous exchange happens is the like-kind exchange occurs within the exact same day. This is the original 1031 exchange form until the law of tax obligations is upgraded to permit the opportunity for other types.

Delayed

Delayed exchange occurs if you market the residential or commercial property, obtain cash, and also purchase an additional residential property by delay. The hold-up may take place for a single day to a couple of months prior to you ultimately obtain the replacement residential property. If the replacement residential property is not purchased within the Internal Revenue Service’ determined period, after that you require to pay your residential or commercial property sale’s capital gain.

Improvement

Also referred to as construction exchange, Improvement exchange occurs when you wish to make use of tax-deferred money to improve the replacement property. Nevertheless, the cash is kept by the middle man.

Reverse

Reverse exchange occurs if you purchase the residential or commercial property initially, and then exchange it in the future. In this circumstance, you require to purchase the replacement residential or commercial property initially then organize the second residential or commercial property’s sale. This kind of exchange is not really usual to be used, since the bargains require to be completely in cash.

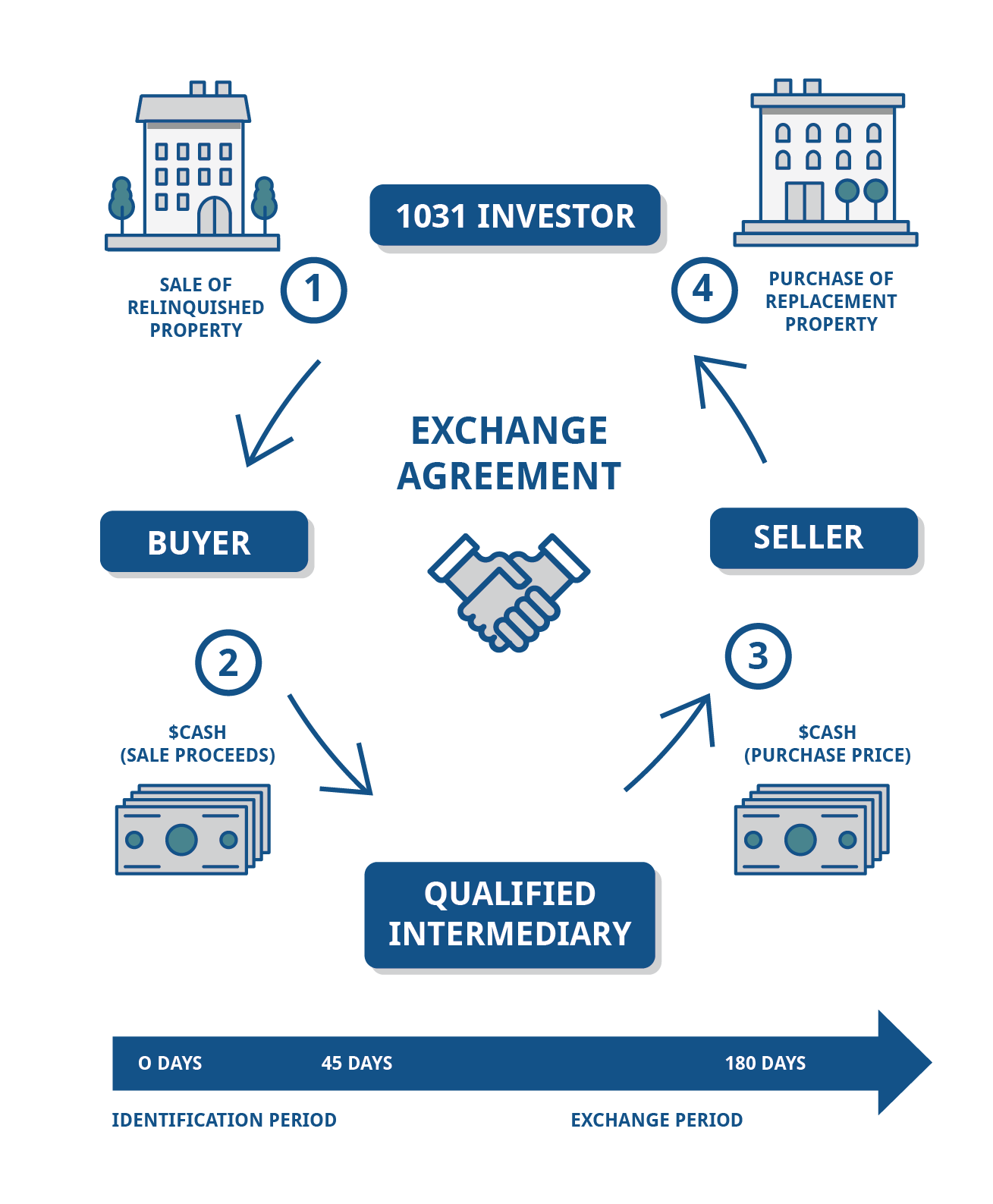

Delayed Exchanges and Timing Rules

There are 2 timing rules that essentials and also have to be observed throughout the Delayed exchanges:

45-Day Rule

The rule is connected with the visit of the replacement property. Once the residential property transaction occurs, the center guy needs to receive the cash money. You need to not receive the cash as it’ll damage the 1031 exchange.

Within the span of 45 days after the residential or commercial property is sold, the substitute residential or commercial property should be assigned to the middle man, as well as the property that you desire to get must be specified. According to Internal Revenue Service, you might assign as much as 3 residential properties, as long as you are nearby to among the 3. If they meet with specific appraisal tests, it’s even feasible to mark beyond 3 residential properties.

180-Day Rule

The timing rule associates with closing in the context of a Delayed exchange. The new property needs to be closed in the span of 180 days after the old is marketed.

1031 Exchange Depreciation Rules

Depreciation could be a property investor’s closest friend, leading to great tax cost savings every year in regards time for you to document leasing earnings towards the IRS.

One of the significant drawbacks of depreciation is the fact that it could be a little bit complicated to determine. For instance, the first and final year’s depreciation should be prorated based on whenever you purchase and market the home. If one makes any capital enhancements, they have to be put into the price schedule from the home and your yearly depreciation write-offs can change. And, you will have to have an operating complete on the years to keep an eye on your complete depreciation.

A 1031 exchange will help you steer clear of capital gains and depreciation recapture income taxes, however, it provides an additional coating of problems towards the depreciation procedure. So, here is a fast manual to assist you to get around the depreciation agenda for your home right after you have finished a 1031 exchange.

IRC Section 1031 Fact Sheet PDF

Loading...

Loading...

HOPE THIS ARTICLE HELPS YOU!

IF YOU ARE STILL HAVING PROBLEM OR CONFUSED ABOUT [KEYWORD], YOU MAY CONSULT WITH A TAX EXPERT THROUGH THIS LINK OR WITH A FINANCE EXPERT THROUGH THE CHAT BOX RIGHT BELOW.