Table of Contents

1031 Exchange 45 Day Rule – 1031 Exchange Rules 2021 is a real estate term that describes the swap in financial investment residential or commercial property in order to delay tax obligations of capital gains. The name is acquired from Section 1031 of the IRS code, which describes investors, real estate professionals, and title firms.

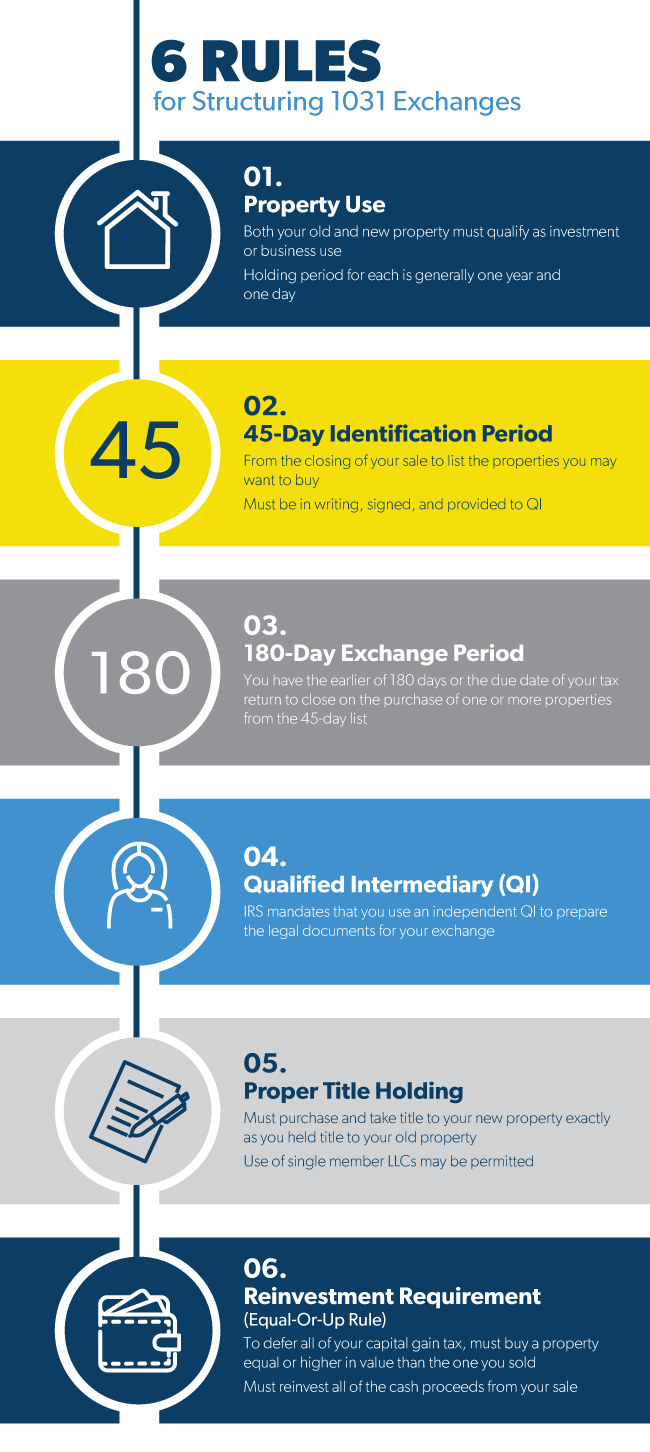

There are plenty of dynamic parts within Section 1031 that vital to be comprehended before you attempt to utilize them. Exchange can be done only for “like-kind” residential properties as well as the uses are limited for holiday residential properties by IRS. There likewise exist ramifications of tax obligations as well as timespan that could be turned against the users. Consequently, if you still intend to learn about the rules, proceed to check out the list below flow.

What Are 1031 Exchange Rules?

As mentioned in prior, 1031 exchange is an act of swapping investment properties. It is additionally commonly referred to as Starker or like-kind exchange. Most of swaps are applicable for tax obligations as sales, but you may postpone tax obligation or provided with minimal tax obligation if you can meet the 1031 exchange’s requirements.

As the result, according to IRS, you will be able to change the financial investment forms without the financial investment being acknowledged as capital gain or being paid out. 1031 is primarily can be done for limitless amounts of times. You might not obtain earnings from every solitary swap, however you will avoid tax till the financial investment is sold, even if it takes years later.

The 1031 Exchange Rules 2021 is utilized for the residential property of organization and investment just. Nonetheless, it could be able to relate to the primary residence residential or commercial property under some problems. It is also in fact possible to apply 1031 for vacation residential properties, but the opportunity is so reduced now contrasted to times earlier.

What Are Types of 1031 Exchange Rules?

Simultaneous

Simultaneous exchange happens is the like-kind exchange happens within the same day. This is the original 1031 exchange type up until the law of tax obligations is upgraded to enable the opportunity for other types.

Delayed

Delayed exchange happens if you offer the residential property, obtain cash money, and acquisition another property by delay. The delay might happen for a single day to a few months prior to you finally acquire the substitute residential property. If the substitute residential property is not purchased within the Internal Revenue Service’ determined period, after that you require to pay your property sale’s capital gain.

Improvement

Additionally referred to as building and construction exchange, Improvement exchange occurs when you intend to use tax-deferred cash to improve the substitute residential property. Nevertheless, the cash is maintained by the middle male.

Reverse

Reverse exchange occurs if you buy the property first, and after that exchange it in the future. In this situation, you require to buy the replacement residential property first after that arrange the second residential property’s sale. This type of exchange is not actually common to be used, since the bargains require to be completely in cash.

Delayed Exchanges and Timing Rules

There are 2 timing rules that fundamentals as well as need to be observed during the Delayed exchanges:

45-Day Rule

The rule is connected with the appointment of the substitute residential or commercial property. The middle man needs to get the money once the residential property deal occurs. You ought to not get the cash money as it’ll damage the 1031 exchange.

Within the span of 45 days after the residential property is marketed, the substitute residential property need to be marked to the middle man, as well as the property that you desire to acquire should be specified. According to IRS, you might designate approximately three residential properties, as long as you neighbor to among the three. If they meet with particular assessment tests, it’s also possible to assign past 3 residential or commercial properties.

180-Day Rule

The timing rule relates to closing in the context of a Delayed exchange. The new residential property should be closed in the span of 180 days after the old is marketed.

IRC Section 1031 Fact Sheet PDF

Loading...

Loading...

HOPE THIS POST HELPS YOU!

IF YOU ARE STILL HAVING PROBLEM OR PUZZLED ABOUT [KEYWORD], YOU MAY CONSULT WITH A TAX EXPERT THROUGH THIS LINK OR WITH A FINANCE EXPERT THROUGH THE CHAT BOX RIGHT BELOW.