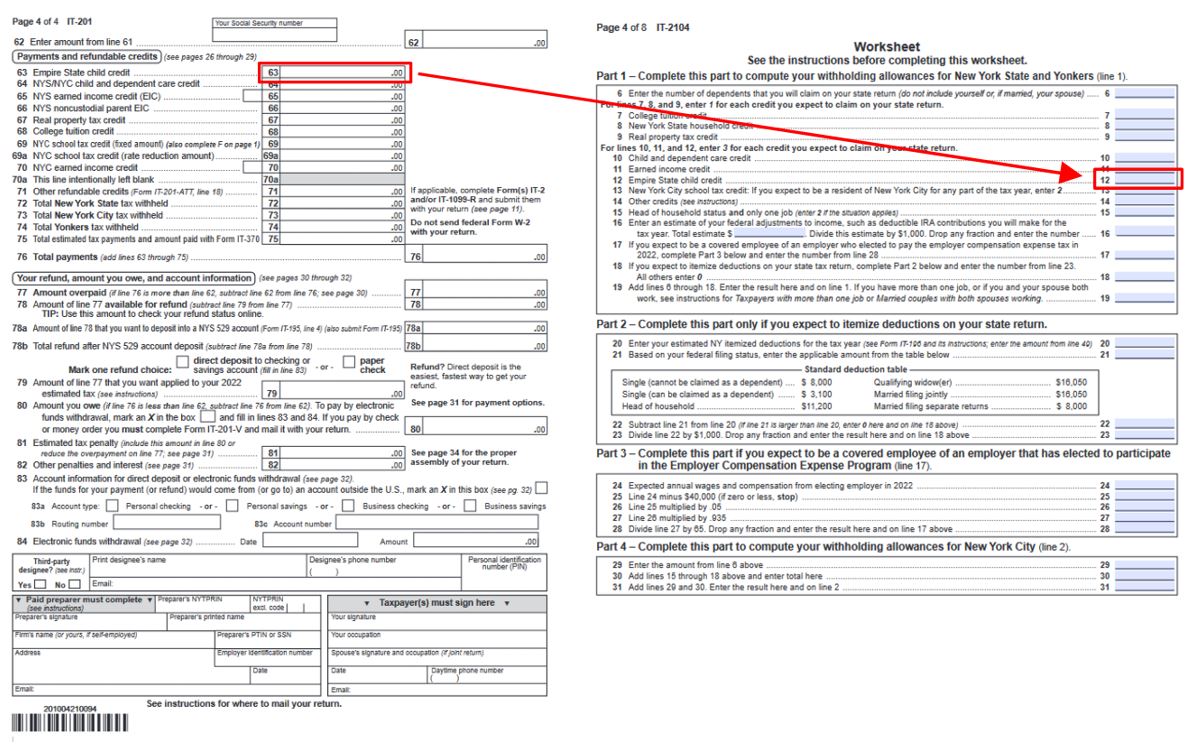

Tips and reminders Form IT 2104 Employee s Withholding Allowance , You must use Form IT 2104 E to claim an exemption for withholding Do not claim a withholding allowance for yourself or your spouse if you are married If you have more than 1 000 of income from sources other than wages such as interest dividends or alimony received reduce the number of allowances line 1 and 2 of Form IT 2104 by one . IT 2104 Step by Step Guide Baron Payroll, An IT 2104 form should be filled out every time your company hires a new employee Filling out these forms properly can save you big headaches down the road come tax filing season There are many possible pitfalls to filling out withholding forms properly For example if you claim more than 14 allowances you will have to fill out a

.Sb Form 2104

Sb Form 2104

Tips and reminders Form IT 2104 Employee s Withholding Allowance

You must use Form IT 2104 E to claim an exemption for withholding Do not claim a withholding allowance for yourself or your spouse if you are married If you have more than 1 000 of income from sources other than wages such as interest dividends or alimony received reduce the number of allowances line 1 and 2 of Form IT 2104 by one .

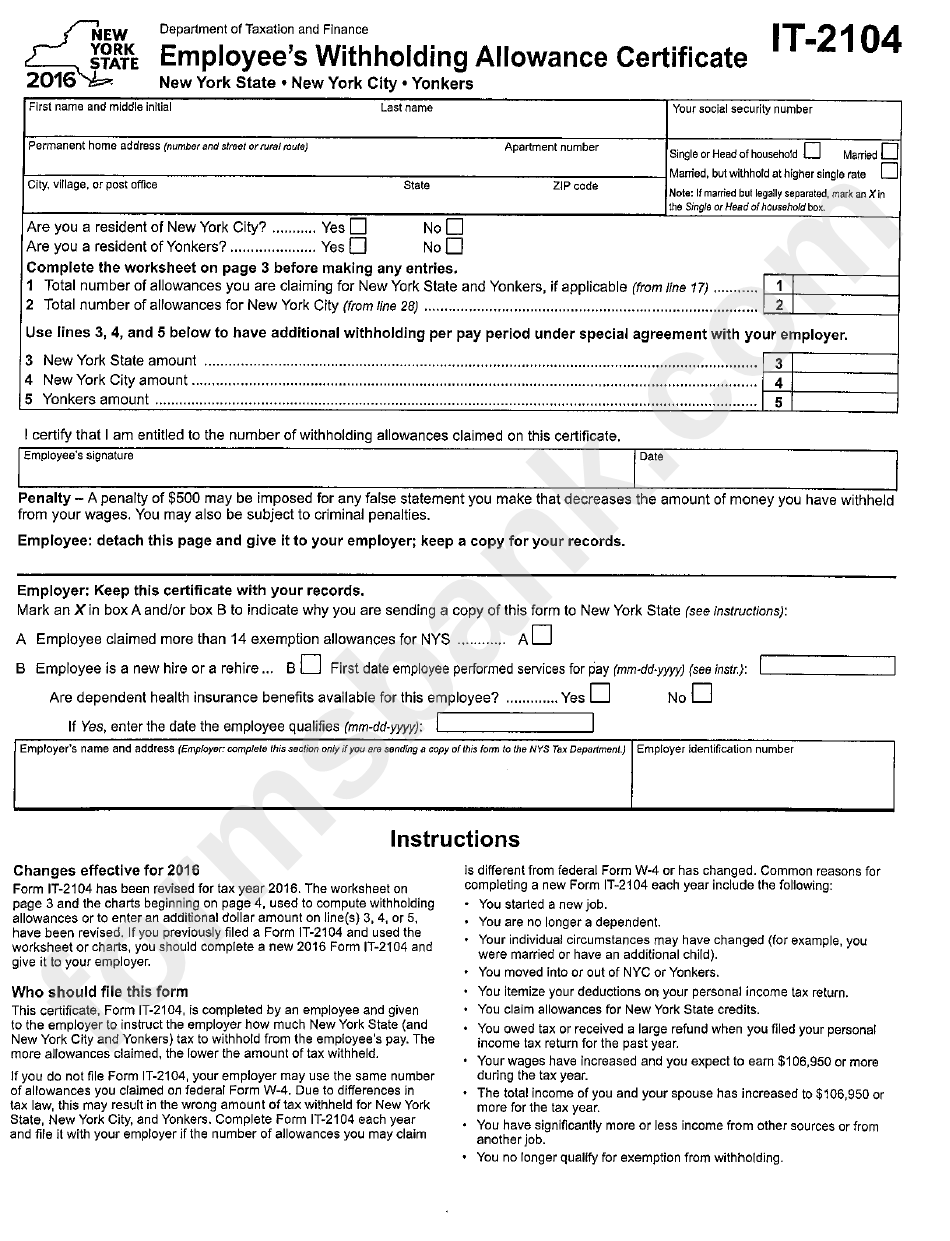

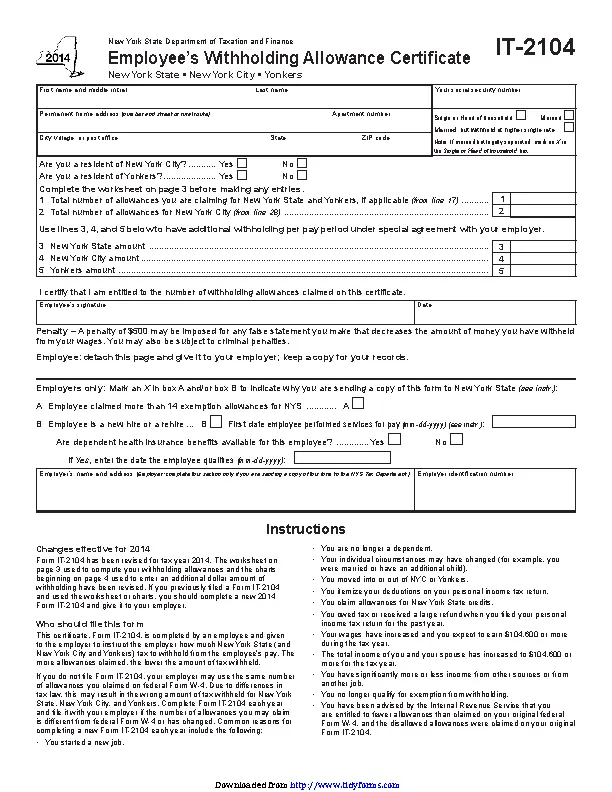

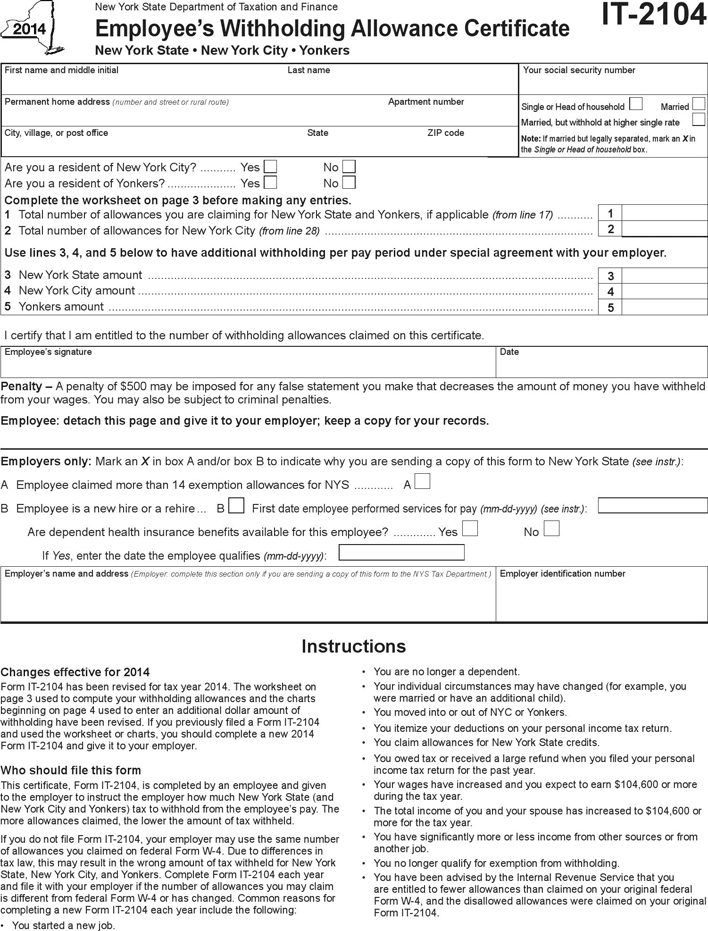

What is the IT 2104 Form Baron Payroll

The IT 2104 form is an essential document for New York employers when it comes to payroll administration It is used to determine the amount of state income tax that should be withheld from each employee s paycheck This form which is similar to a W4 for federal withholding taxes .

https://www.tax.ny.gov/forms/income_with_allow_forms.htm

IT 2104 1 Fill in Instructions on form New York State City of New York and City of Yonkers Certificate of Nonresidence and Allocation of Withholding Tax Other information Income tax resources and publications Updated December 13 2024 Department of Taxation and Finance Get help

https://www.tax.ny.gov/pit/file/it2104-filing-tips.htm

You must use Form IT 2104 E to claim an exemption for withholding Do not claim a withholding allowance for yourself or your spouse if you are married If you have more than 1 000 of income from sources other than wages such as interest dividends or alimony received reduce the number of allowances line 1 and 2 of Form IT 2104 by one

New York Releases Updated Form IT 2104 Employee s Withholding

New York recently released an update to its 2021 Form IT 2104 the Employee s Withholding Allowance Certificate The IT 2104 is used for claiming withholding allowances for New York State New York City and Yonkers No changes were made to the form itself but a couple of notable changes and additions have been made to the on form instructions .

span class result type PDF span Employee s Withholding Allowance CertificateIT 2104 St John s

State New York City and Yonkers Complete Form IT 2104 each year and file it with your employer if the number of allowances you may claim is different from federal Form W 4 or has changed Common reasons for completing a new Form IT 2104 each year include the following You started a new job You are no longer a dependent .

span class result type PDF span IT 2104 Employee s Withholding Allowance Certificate NYC gov

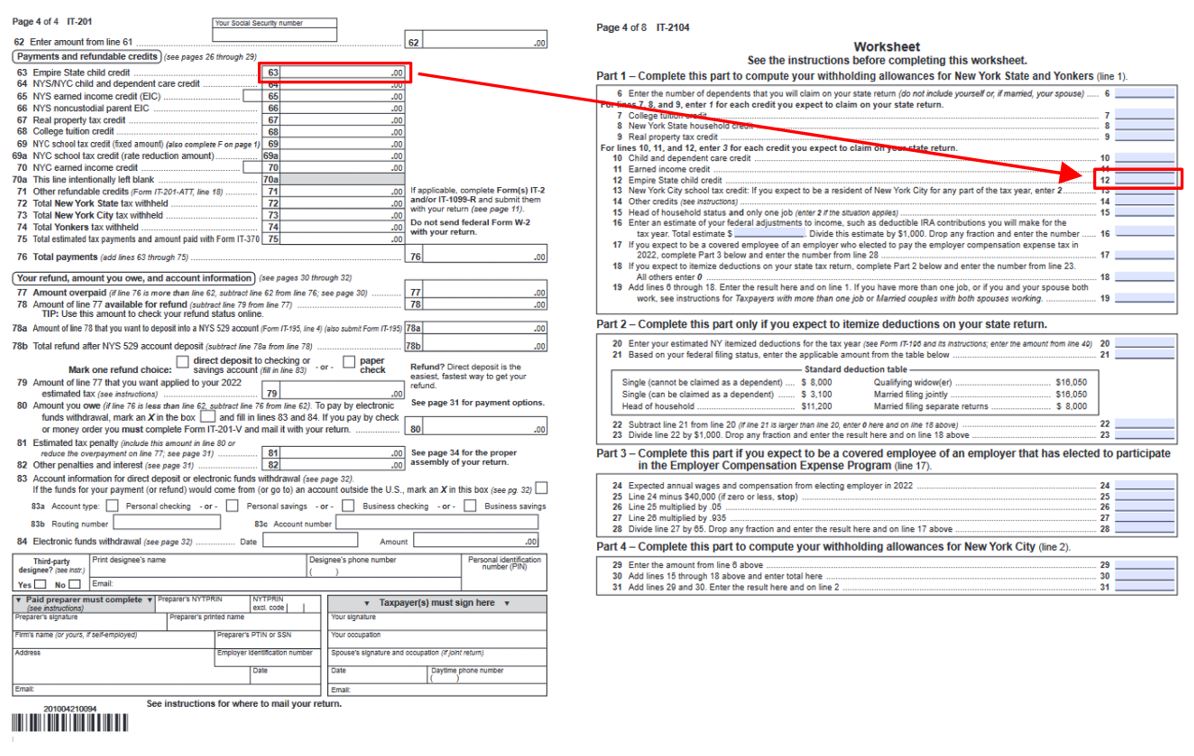

Form IT 2104 has been revised for tax year 2020 The worksheet on page 4 and the charts beginning on page 5 used to compute withholding allowances or to enter an additional dollar amount on line s 3 4 or 5 have been revised If you previously filed a Form IT 2104 and used the worksheet or charts you should complete a new 2020 Form IT 2104 and.

New York State Withholding Certificate IT 2104

To identify and withhold the correct New York State New York City and or Yonkers tax If you do not submit this form your withholdings will default to a filing status of single and you claim 1 allowances If you transferred from another state agency your withholding elections will transfer with you Download the Form .

Disclaimer: The images presented on this website are possessed by their copyright owners. Reach out to us with any kind of worries regarding credit rating or removal.