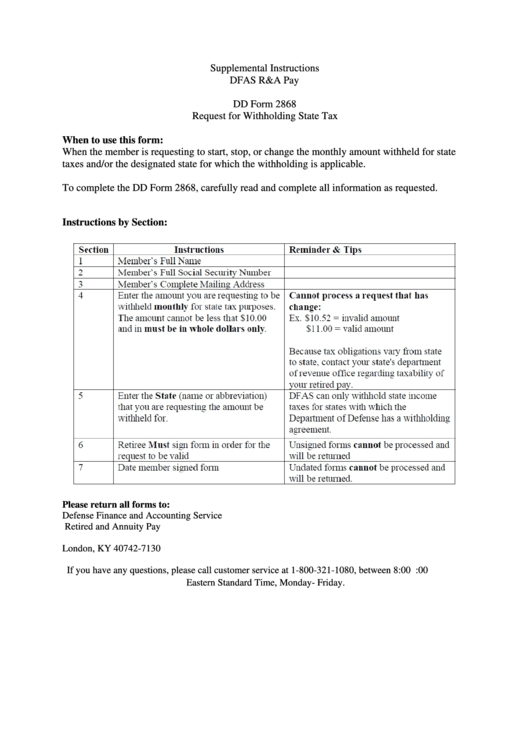

span class result type PDF span Supplemental Instructions DFAS R A Pay DD Form 2868, DD Form 2868 Request for Withholding State Tax When to use this form When the member is requesting to start stop or change the monthly amount withheld for state taxes and or the designated state for which the withholding is applicable To complete the DD Form 2868 carefully read and complete all information as requested Instructions by . span class result type PDF span DD Form 2860 Claim for Combat Related Special Compensation CRSC , Complete this form carefully and accurately To submit a valid claim you must complete the ENTIRE FORM and SIGN IT IN SECTION VI bottom of Page 3 Unsigned claim forms will not be processed Complete and submit this form pages 1 3 ONLY to apply for Combat Related Special Compensation CRSC Print type or use a

.Dd Form 2868

Dd Form 2868

span class result type PDF span Supplemental Instructions DFAS R A Pay DD Form 2868

DD Form 2868 Request for Withholding State Tax When to use this form When the member is requesting to start stop or change the monthly amount withheld for state taxes and or the designated state for which the withholding is applicable To complete the DD Form 2868 carefully read and complete all information as requested Instructions by .

DoD Forms Management Executive Services Directorate

In coordination with the DoD CIO the DD establishes policies and procedures for the DoD Forms Management Program including responsibilities for reviewing and approving form requirements DoD forms satisfy a valid need essential to accomplish a mission and necessary for the efficient and economical operation of the DoD .

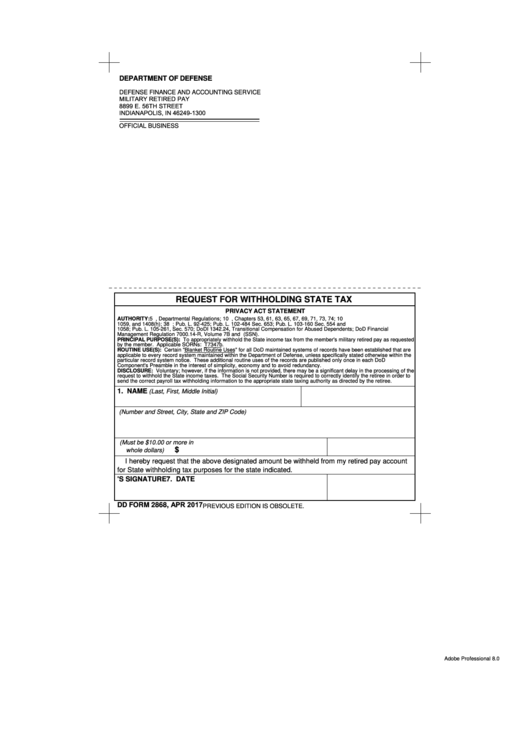

https://www.dfas.mil/RetiredMilitary/forms/

DD 2868 Request for Withholding State Tax Instructions IRS W 8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding DD 2656 6 Form Wizard DD 2656 6 Printable PDF Form Survivor Benefit Plan Election Change Certificate SBP Withdrawal Due to VA Disability Packet

https://www.dfas.mil/Portals/98/Documents/RetiredMilitary/forms/Supplemental%20Instructions%20DD%20Form%202868%20Req%20Withold%20State%20Tax.pdf?ver=2020-04-17-105923-887

DD Form 2868 Request for Withholding State Tax When to use this form When the member is requesting to start stop or change the monthly amount withheld for state taxes and or the designated state for which the withholding is applicable To complete the DD Form 2868 carefully read and complete all information as requested Instructions by

DLA Sponsored DD Forms Defense Logistics Agency

Single Line Item Requisition System Document Manual Long Form Feb 1985 Information Technology DD1348 7 DoD MILSPETS DFSP Shipment and Receipt Document Aug 2006 Energy DD1348 8 DoD MILSPETS DFSP Inventory and End of Month Report Jul 2006 Energy DD1348M Single Line Item Requisition System Document Mechanical Mar 1975 .

DoD Transition Assistance Program

The following forms have been superseded by the above DD eForm 2648 and are no longer utilized to document a Service member s separation DD Form 2648 Active Duty Pre Separation Checklist DD Form 2648 1 National Guard and Reserve Pre Separation Checklist DD Form 2958 Individual Transition Plan ITP Checklist.

Forms MyNavyHR

DD 214 and Military Personnel Record Requests Department of Defense DD Issuances Forms and Publications Federal Employees Group Life Insurance FEGLI Forms General Services Administration GSA Forms Forms Online Official source for procurement of specialty printed warehouse stocked and controlled Navy forms .

DD Form 2868 Fill Out Sign Online and Download Fillable PDF

A Yes DD Form 2868 is applicable to both active duty and reserve military personnel Q Are there any penalties for not using DD Form 2868 to withhold state taxes A There may not be any penalties for not using DD Form 2868 but you may be responsible for paying your state taxes independently Q Can I use DD Form 2868 to withhold federal taxes .

Disclaimer: All pictures featured on this website are the home of their particular copyright proprietors. If you have any inquiries or worries regarding acknowledgment or photo elimination, please don't think twice to contact us.