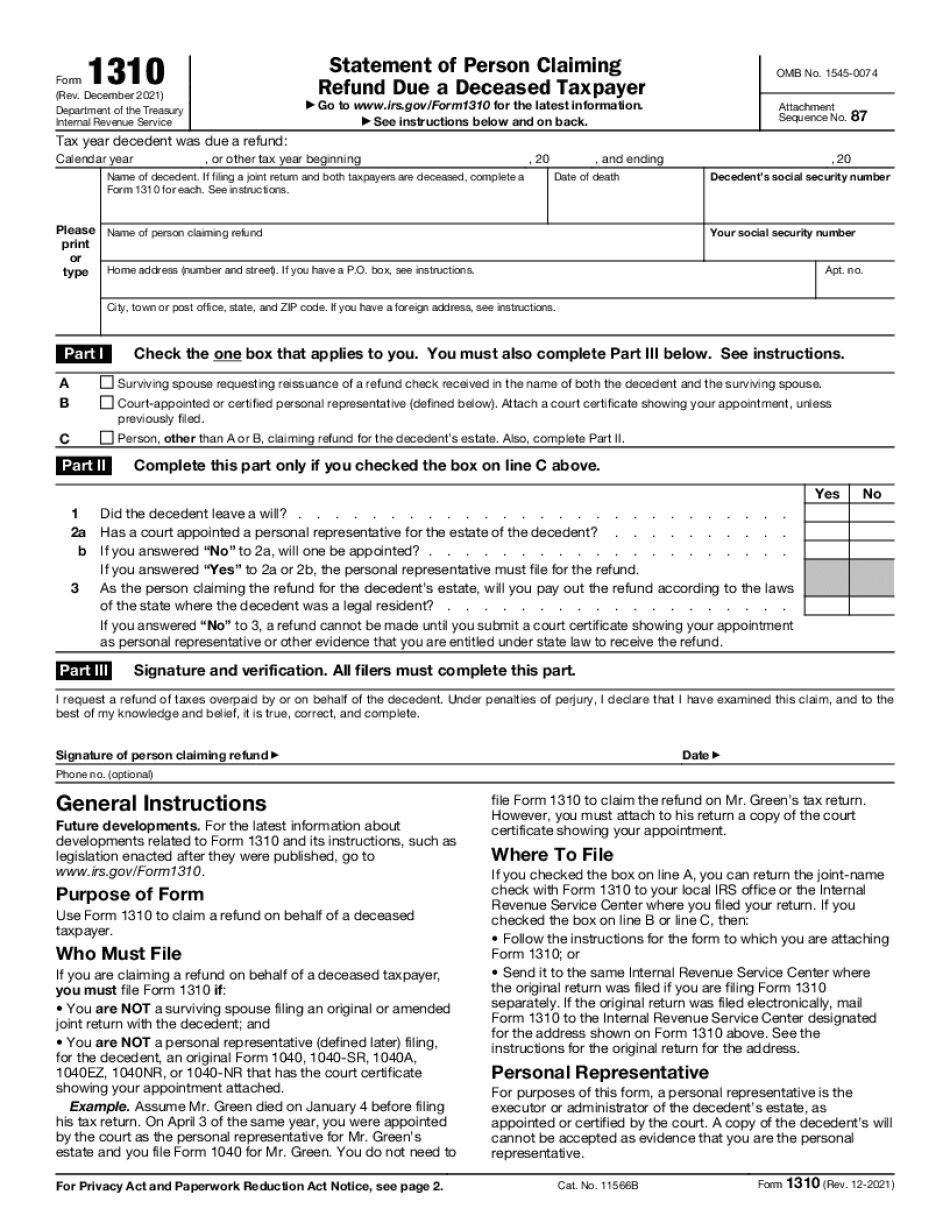

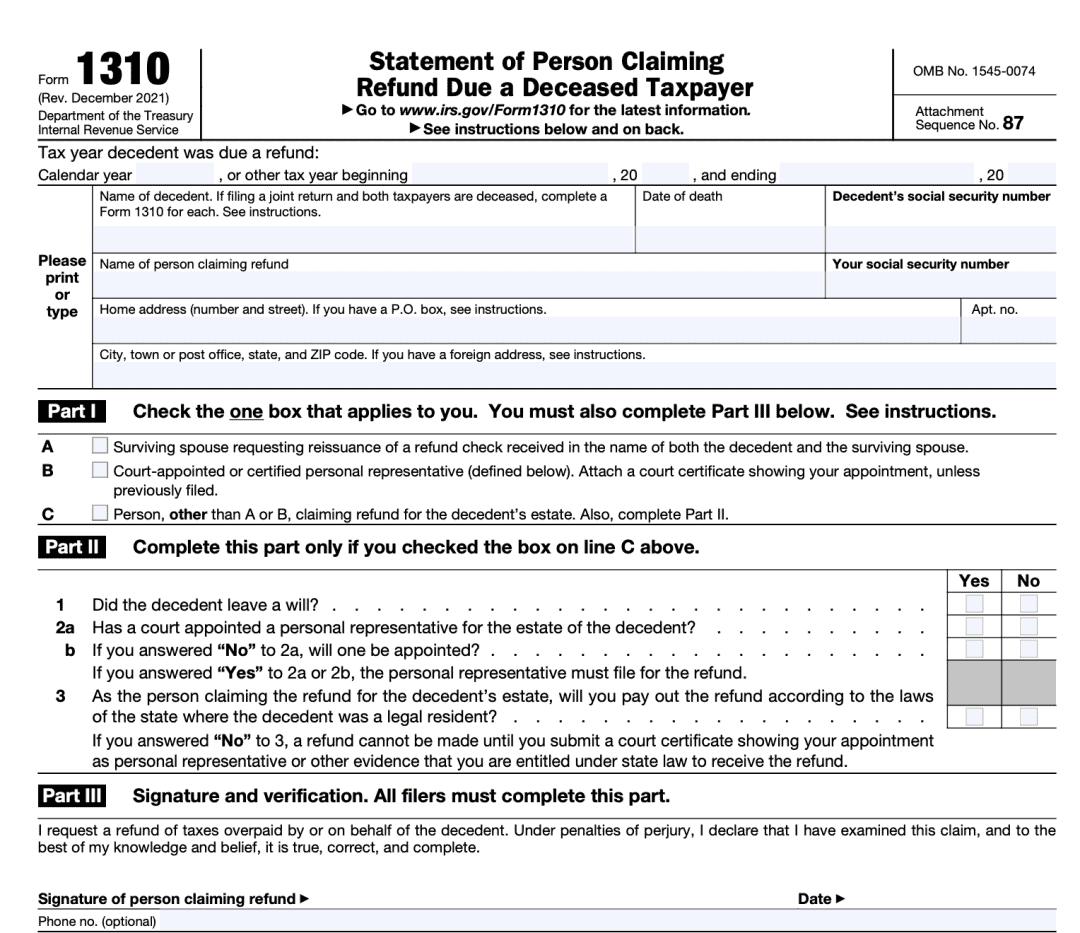

Army Publishing Directorate, We would like to show you a description here but the site won t allow us . Are You Still Waiting on a Refund From a Deceased Taxpayer s Return , IRS Form 1310 is filed to claim a refund on behalf of a deceased taxpayer When a taxpayer dies the taxpayer s personal representative or surviving spouse must file a final income tax form Form 1040 or 1040 SR for the year of death in addition to any returns not filed in preceding years If a refund is claimed on a final income tax

.Dd Form 1310

Dd Form 1310

Army Publishing Directorate

We would like to show you a description here but the site won t allow us .

How to File IRS Form 1310 Refund Due a Deceased Taxpayer

Form 1041 should be filed along with Form 1310 if the estate owes taxes because the decedent had assets that generated over 600 of gross income within 12 months of the death and that income did not go straight to the surviving spouse or heirs This can happen if the decedent owned rental property or held investments that continued to generate .

https://www.irs.gov/pub/irs-pdf/f1310.pdf

If you checked the box on line B or line C file Form 1310 as follows If you are attaching Form 1310 to a form follow the instructions for the form to which you are attaching the Form 1310 Form 1310 can be filed electronically when it is attached to a Form 1040 1040 SR 1040 NR or 1040 SS being filed electronically

https://armypubs.army.mil/ProductMaps/PubForm/Details.aspx?PUB_ID=1007064

We would like to show you a description here but the site won t allow us

Guide to Filing Form 1310 for Deceased Taxpayers Claiming Refunds

When filing Form 1310 ensure that you meet the IRS s requirements for attachments related to the deceased person s final tax return Form 1040 These attachments may include W 2 forms 1099 forms or other relevant documentation Keep in mind that Form 1310 cannot be e filed and must be mailed directly to the IRS to complete the process .

IRS Form 1310 What is it Requirement for Filing

IRS Form 1310 is attached with the regular tax refund form 1040 to get a refund and the 1310 form requires details about the deceased taxpayer including their name social security number date of death and much more Individuals have to provide their own information and their relationship details with the deceased person during filing 1310 form .

IRS Form 1310 Instructions Tax Refund on A Decedent s Behalf

IRS Form 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer is the tax form that you can use to notify the Internal Revenue Service of a taxpayer s death If the taxpayer was owed a tax refund at the time of death IRS Form 1310 will direct the IRS where to send the refund .

Form 1310 Definition Filing Process and Benefits

Form 1310 Statement of person claiming refund due a deceased taxpayer is an essential IRS document used to claim a federal tax refund for beneficiaries of a deceased taxpayer This article provides a comprehensive guide to Form 1310 explaining its purpose who can file it and how to do so Whether you re a surviving spouse beneficiary or executor of the deceased s estate .

Disclaimer: All images included on this website are the home of their particular copyright proprietors. If you have any inquiries or problems pertaining to photo acknowledgment or contact us.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/archetype/NIBJY5VYSJD47DBBNMJFD7PHKU.png)