What Is Form 5498 IRA Contribution Information NerdWallet, Form 5498 formally called Form 5498 IRA Contribution Information is a document that reports the fair market value of an IRA along with any changes to that IRA including contributions . What Is IRS Form 5498 for IRA Contributions SoFi, In addition to the 5498 tax form for IRA contributions you may also be issued either of the following Form 5498 ESA This form is issued if you make contributions to a Coverdell Education Savings Account ESA on behalf of an eligible student Distributions from a Coverdell ESA are reported on Form 1099 Q

.Da Form 5498

Da Form 5498

What Is Form 5498 IRA Contribution Information NerdWallet

Form 5498 formally called Form 5498 IRA Contribution Information is a document that reports the fair market value of an IRA along with any changes to that IRA including contributions .

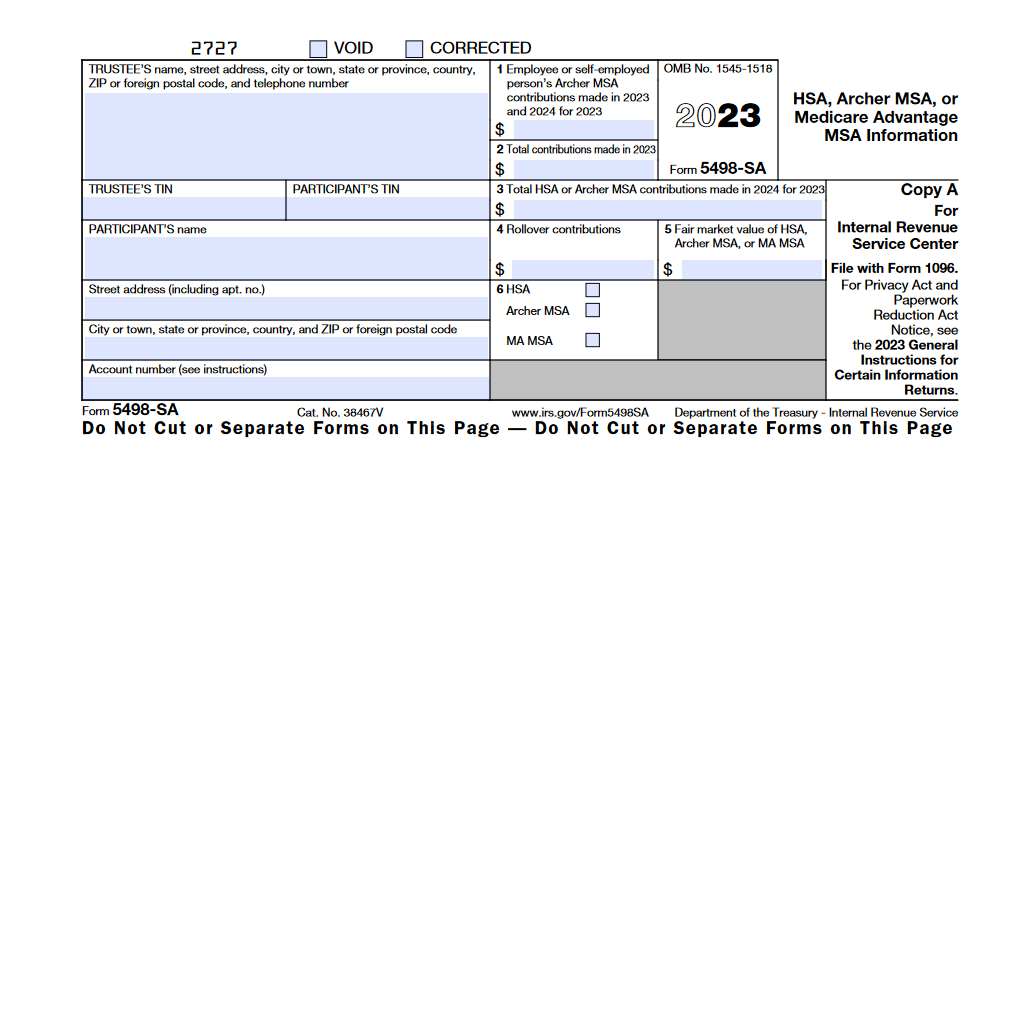

span class result type PDF span 2023 Form 5498 Internal Revenue Service

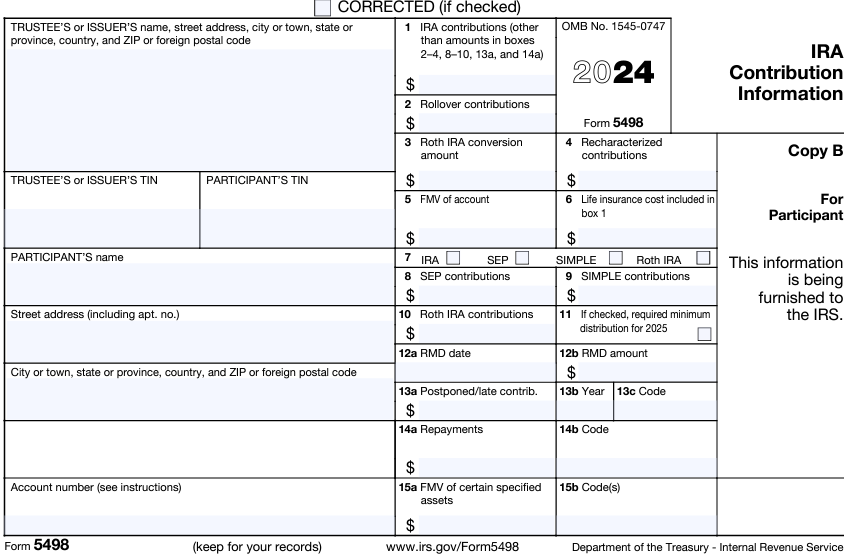

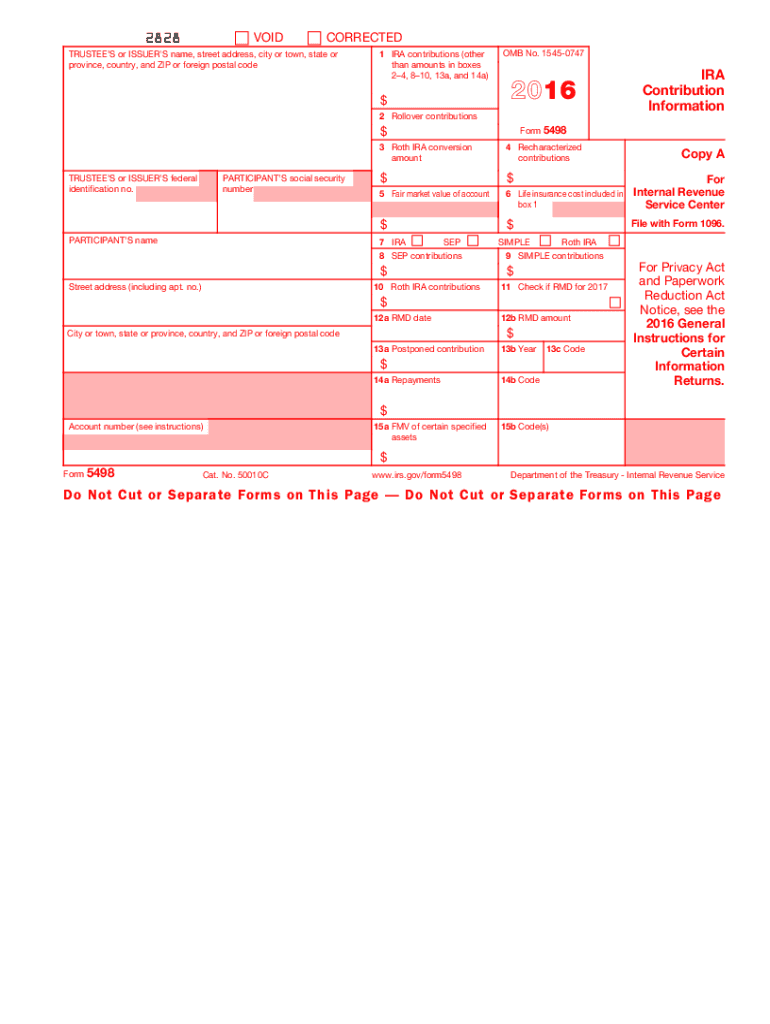

The information on Form 5498 is submitted to the IRS by the trustee or issuer of your individual retirement arrangement IRA to report contributions including any catch up contributions required minimum distributions RMDs and the fair market value FMV of the account For information about IRAs see Pubs 590 A 590 B and 560 .

https://www.irs.gov/forms-pubs/about-form-5498?os=jva&ref=app

Filing Extension and Other Relief for Form 1040 Filers PDF 29 MAR 2021 Rollover Relief for Waived Required Minimum Distributions under CARES Act 24 JUN 2020 Form 5498 due date postponed to August 31 2020 Notice 2020 35 PDF 29 MAY 2020 Taxpayer Relief for Certain Tax Related Deadlines Due To Coronavirus Pandemic 14 APR 2020

https://www.nerdwallet.com/article/taxes/form-5498

Form 5498 formally called Form 5498 IRA Contribution Information is a document that reports the fair market value of an IRA along with any changes to that IRA including contributions

What is IRS Form 5498 IRA Contributions Information

Submit Form to IRS After verifying the information submit Form 5498 through Tax1099 s platform Follow the prompts to complete the submission process After successful submission furnish a copy of form 5498 to each IRA account holder by May 31 2024 And don t forget to keep the copies of all filed 5498 for your records .

5498 Tax Form Explained What You Need to Know for Taxes

A 1099 R form and a 5498 form are both tax forms used in the United States in relation to retirement plans but they serve different purposes Form 1099 R A Form 1099 R is a tax form used to report distributions from pensions annuities retirement plans IRAs and other similar accounts .

What is Form 5498 IRA contribution information Fidelity

Form 5498 is informational you don t have to do anything with it but it may help guide your future distribution decisions Let s say you want to withdraw from your Roth IRA Taking out investment earnings beyond your contributions could result in taxes and penalties before retirement age and meeting other criteria If you hold on to your .

What Is IRS Form 5498 IRA Contributions Information

Form 5498 reports various types of IRA contributions you make and other account information in the reporting boxes of the form Box 1 shows the amount you contributed to an IRA Box 9 reports the amounts contributed to a Savings Incentive Match Plan for Employees SIMPLE IRA while box 8 documents Simplified Employee Pension SEP contributions.

Disclaimer: The photos presented on this website are owned by their copyright owners. Connect to us with any issues about credit report or elimination.