Table of Contents

1031 Like Exchange Rules – 1031 Exchange Rules 2021 is a real estate term that refers to the swap in financial investment residential or commercial property in order to delay tax obligations of capital gains. The name is gotten from Section 1031 of the Internal Revenue Service code, which defines financiers, realtors, and title firms.

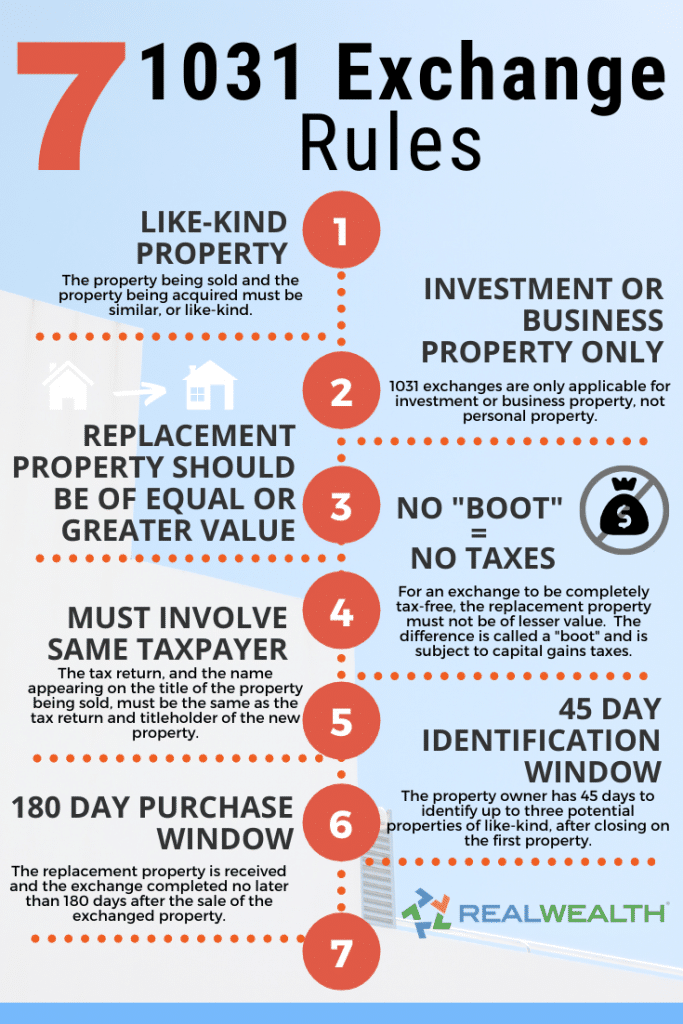

There are plenty of dynamic components within Section 1031 that essential to be understood before you attempt to utilize them. Exchange can be done just for “like-kind” residential or commercial properties and the usages are restricted for holiday properties by IRS.

What Are 1031 Exchange Rules?

As mentioned in prior, 1031 exchange is an act of swapping investment properties. It is also generally described as Starker or like-kind exchange. The majority of swaps are applicable for tax obligations as sales, but you might defer tax obligation or given with limited tax obligation if you can meet the 1031 exchange’s requirements.

As the result, according to Internal Revenue Service, you will be able to modify the investment types without the investment being acknowledged as capital gain or being paid out. 1031 is generally can be done for boundless quantities of times. You may not acquire earnings from every solitary swap, but you will stay clear of tax obligation until the investment is sold, also if it takes years later on.

The 1031 Exchange Rules 2021 is used for the residential or commercial property of organization and financial investment just. Nonetheless, it may be able to relate to the major residence residential property under some conditions. It is likewise really feasible to use 1031 for vacation residential properties, yet the opportunity is so low currently compared to some times ago.

What Are Types of 1031 Exchange Rules?

Simultaneous

Simultaneous exchange occurs is the like-kind exchange occurs within the very same day. This is the initial 1031 exchange form until the law of taxes is updated to enable the possibility for other kinds.

Delayed

Delayed exchange happens if you sell the residential property, obtain cash money, and also purchase another property by hold-up. The delay may take place for a solitary day to a couple of months before you finally get the replacement property. If the substitute residential property is not bought within the Internal Revenue Service’ determined timespan, then you require to pay your property sale’s capital gain.

Improvement

Known as building exchange, Improvement exchange occurs when you desire to use tax-deferred cash to boost the substitute residential or commercial property. The cash is kept by the middle male.

Reverse

Reverse exchange occurs if you buy the property initially, and afterwards exchange it later on. In this scenario, you require to purchase the substitute residential property initially after that organize the 2nd residential property’s sale. This kind of exchange is not truly usual to be made use of, due to the fact that the bargains require to be completely in cash.

Delayed Exchanges and Timing Rules

There are 2 timing rules that basics as well as need to be observed during the Delayed exchanges:

45-Day Rule

The rule is connected with the consultation of the replacement property. Once the property purchase happens, the middle guy must receive the cash money. You must not receive the money as it’ll damage the 1031 exchange.

Within the span of 45 days after the residential property is offered, the replacement residential property must be designated to the middle man, and the residential property that you wish to get ought to be defined. According to IRS, you may assign as much as 3 residential properties, as long as you are nearby to one of the 3. It’s even feasible to designate past three residential properties if they meet specific valuation examinations.

180-Day Rule

The timing rule relates to closing in the context of a Delayed exchange. The new residential property has to be enclosed the period of 180 days after the old is marketed.

IRC Section 1031 Fact Sheet PDF

Loading...

Loading...

HOPE THIS POST HELPS YOU!

IF YOU ARE STILL HAVING PROBLEM OR CONFUSED ABOUT [KEYWORD], YOU MAY CONSULT WITH A TAX EXPERT THROUGH THIS LINK OR WITH A FINANCE EXPERT THROUGH THE CHAT BOX RIGHT BELOW.